- "New" AI Data Audit

- …

- "New" AI Data Audit

- "New" AI Data Audit

- …

- "New" AI Data Audit

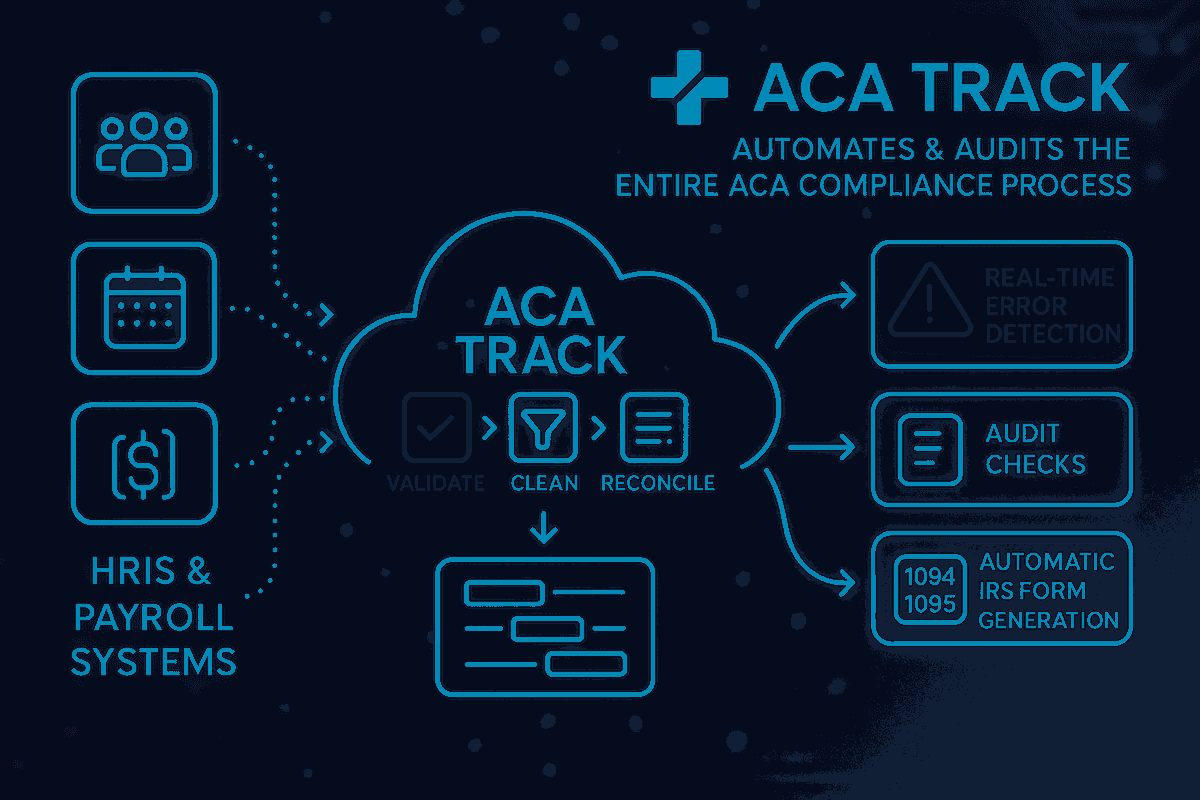

Automate ACA Compliance

Reduce Processing Time 90%

For HR leaders, benefits professionals, and compliance teams — ACA TRACK software automates ACA compliance and eliminate penalties.

From Data Import To E-File In Minutes

ACA TRACK helps HR and compliance teams eliminate manual 1095-C errors, streamline eligibility tracking, and stay ahead of every IRS and state mandate. This is a 100% automated process.

Current ACA TRACK Customers

Over 5,000,000 Million 1095 Forms Completed

5,000,000 Forms Completed

1,000,000 Employee Records Annually

Zero Late Penalties Since 2015

Zero Incorrect Code Penalties Since 2015

ACA Compliance

Manual vs Automated

Why Manual ACA Tracking Fails

Manual ACA tracking depends on spreadsheets, one-off reports, and hand-applied codes. Data must be reconciled across payroll, benefits, and HRIS systems—often by different people on tight deadlines. The result is slow cycles, coding mistakes, and exposure to penalties.

- Coding Errors on Lines 14/16: Human entry leads to inconsistent offer/coverage codes, affordability misapplied, and downstream corrections.

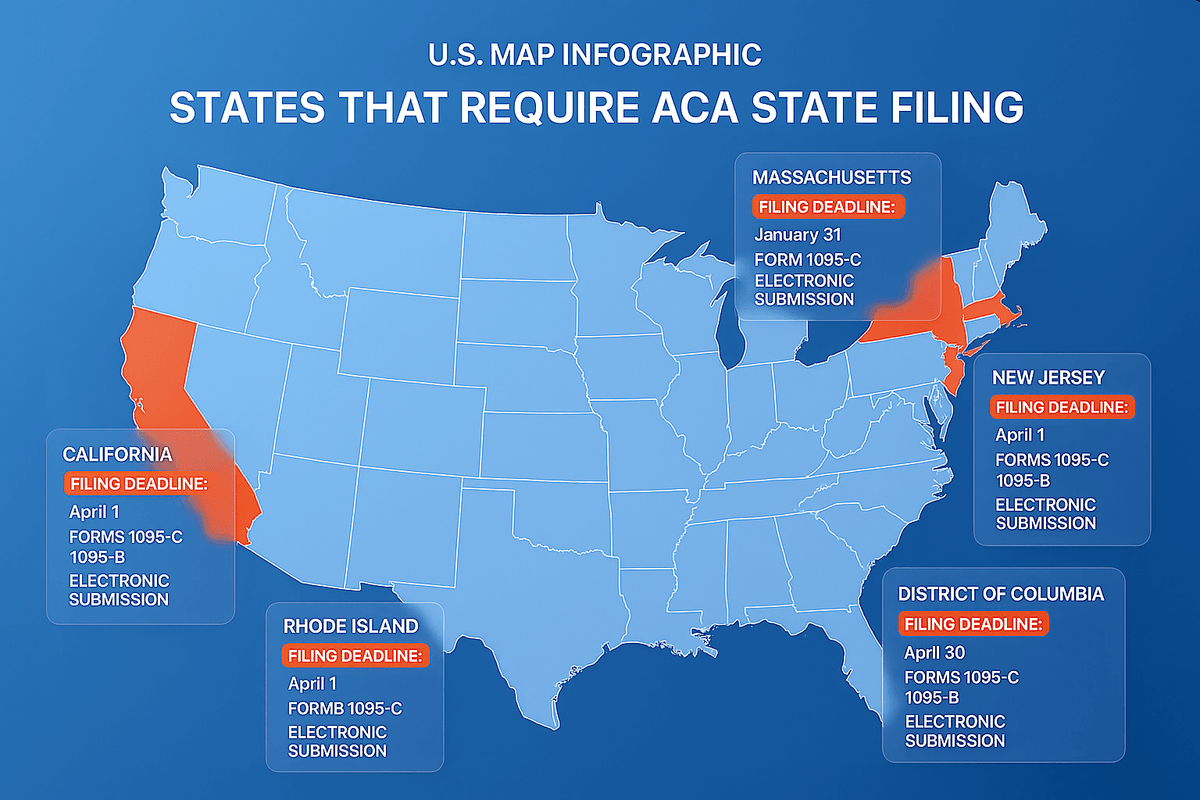

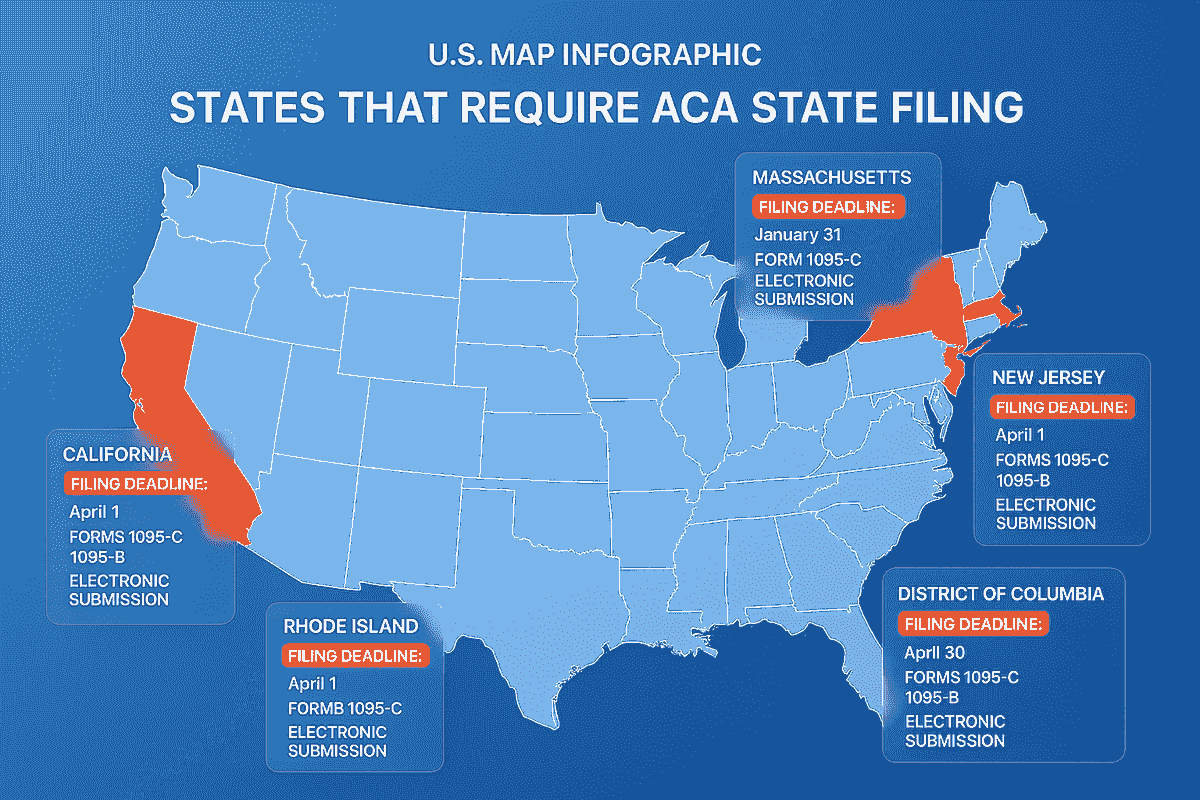

- Missed or Mismatched Deadlines: IRS AIR transmissions and state add-on filings follow different calendars and formats. Manual timelines slip.

- Fragmented Data Dources: Eligibility, affordability, and offer status live in separate systems without an authoritative record.

- No Dudit Trail: Ad hoc spreadsheets lack version control and approver history, complicating defense during audits.

- Scale Breaks Down: As headcount or states increase, manual checks can’t keep pace.

ACA Compliance Automation

Automation centralizes payroll, benefits, and HR data; applies the correct codes; and validates filings before submission. Teams move from reactive cleanup to proactive compliance.

- Unified Data Ingestion: Continuous imports create one source of truth for eligibility, affordability, and offer codes.

- Data Mapping: Use the data format and language that is represented in your systems. Our system converts your codes and language to the IRS requirements.

- Built-in Code Engine: Accurate Line 14 | 16 coding and affordability safe harbors—applied consistently.

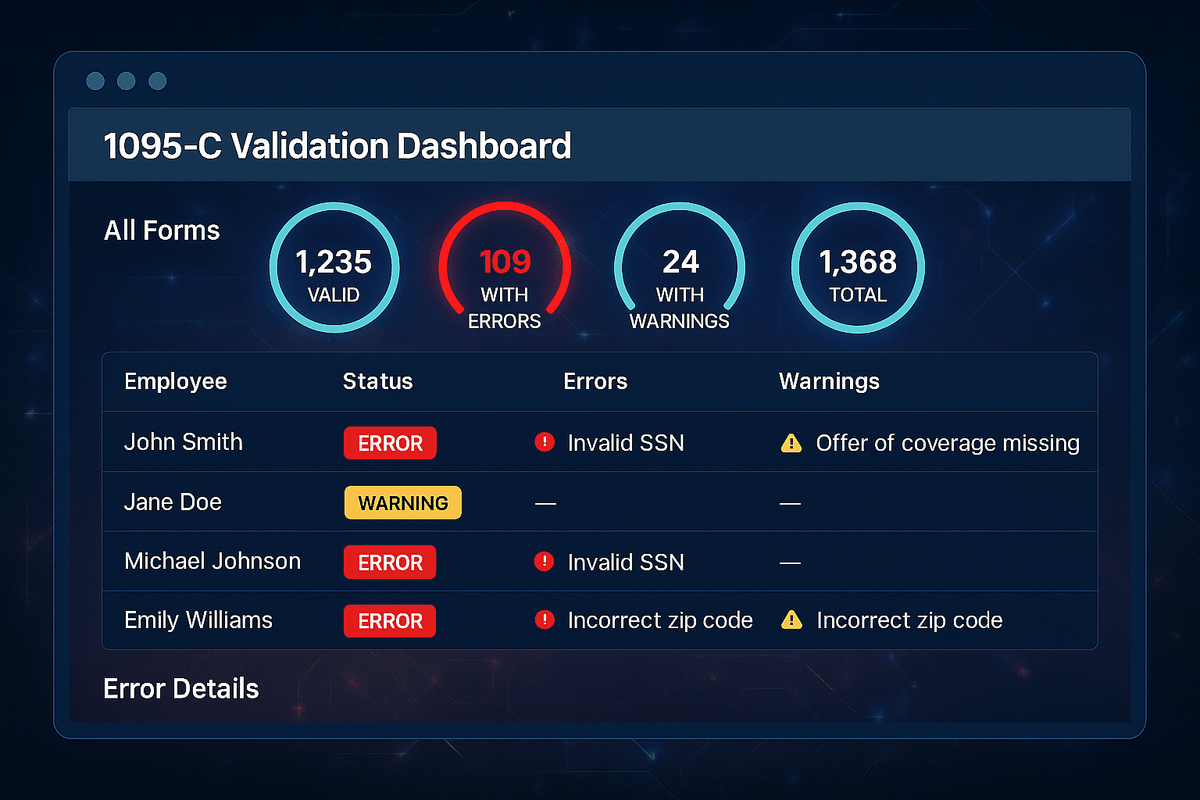

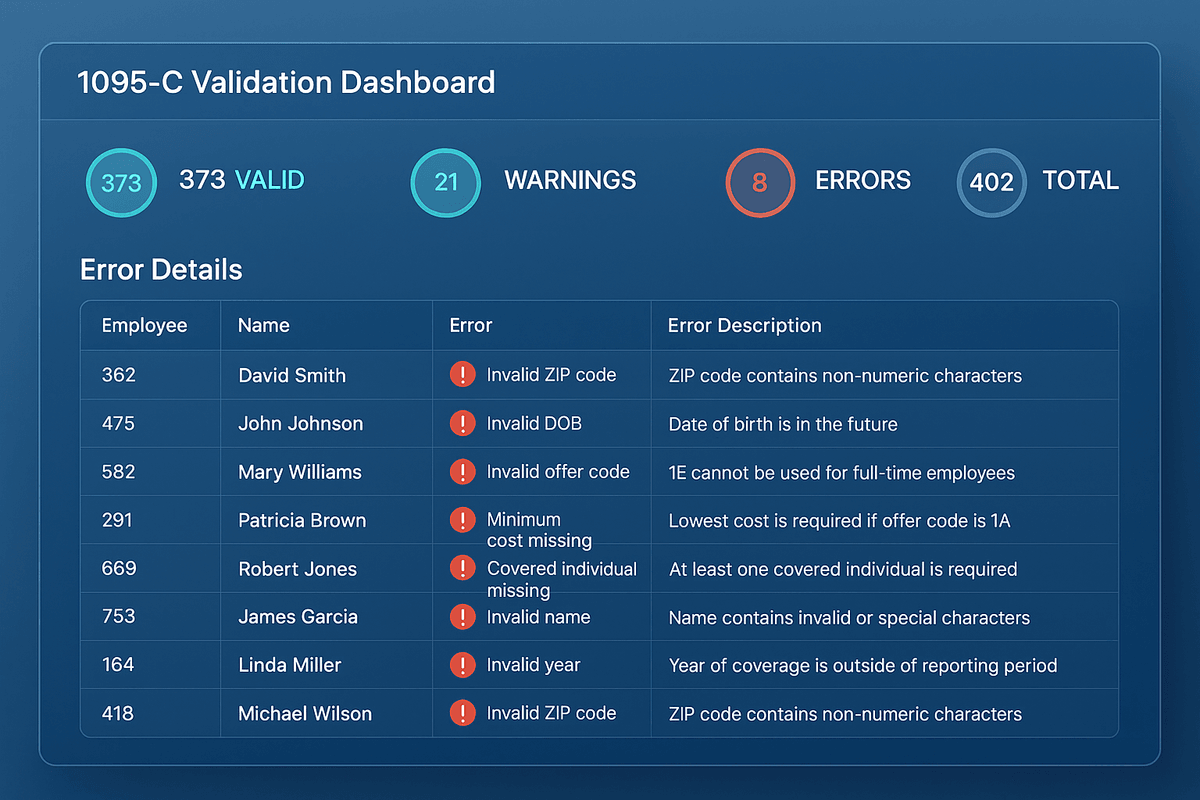

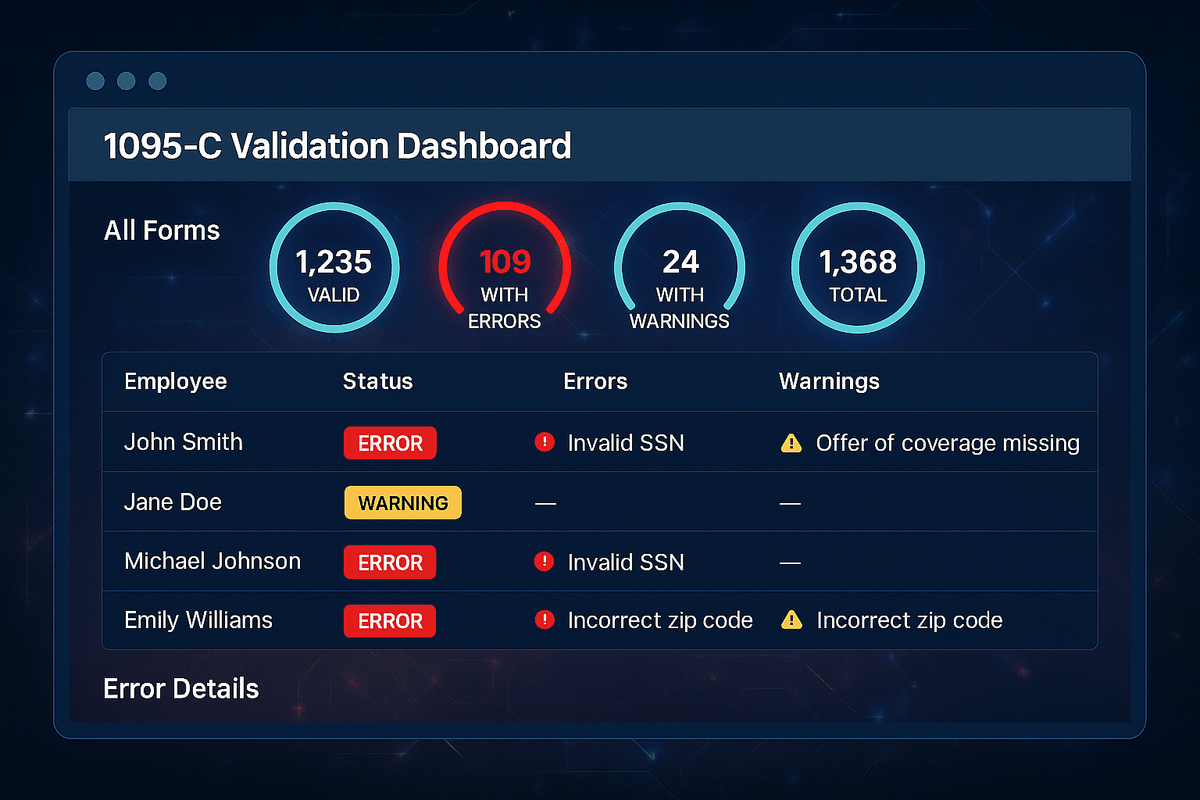

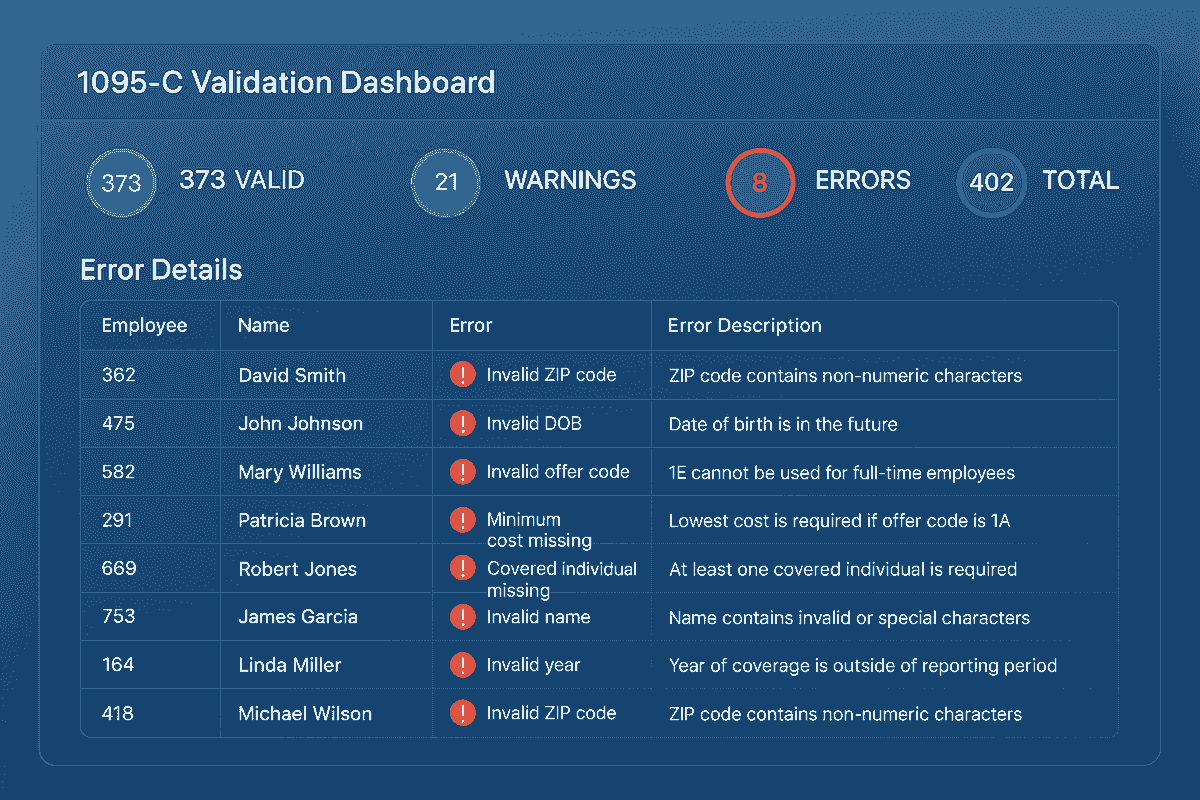

- Automated Validations: Pre-submission checks surface missing SSNs, coverage gaps, and AIR schema errors early.

- State Workflows: Separate rules for each state handled with correct formats and due dates.

- Audit-Ready History: Time-stamped logs of changes, approvals, and submissions.

- Collaboration + Concierge: Role-based tasks for HR, payroll, and brokers with expert support when needed.

Automation of Data Files

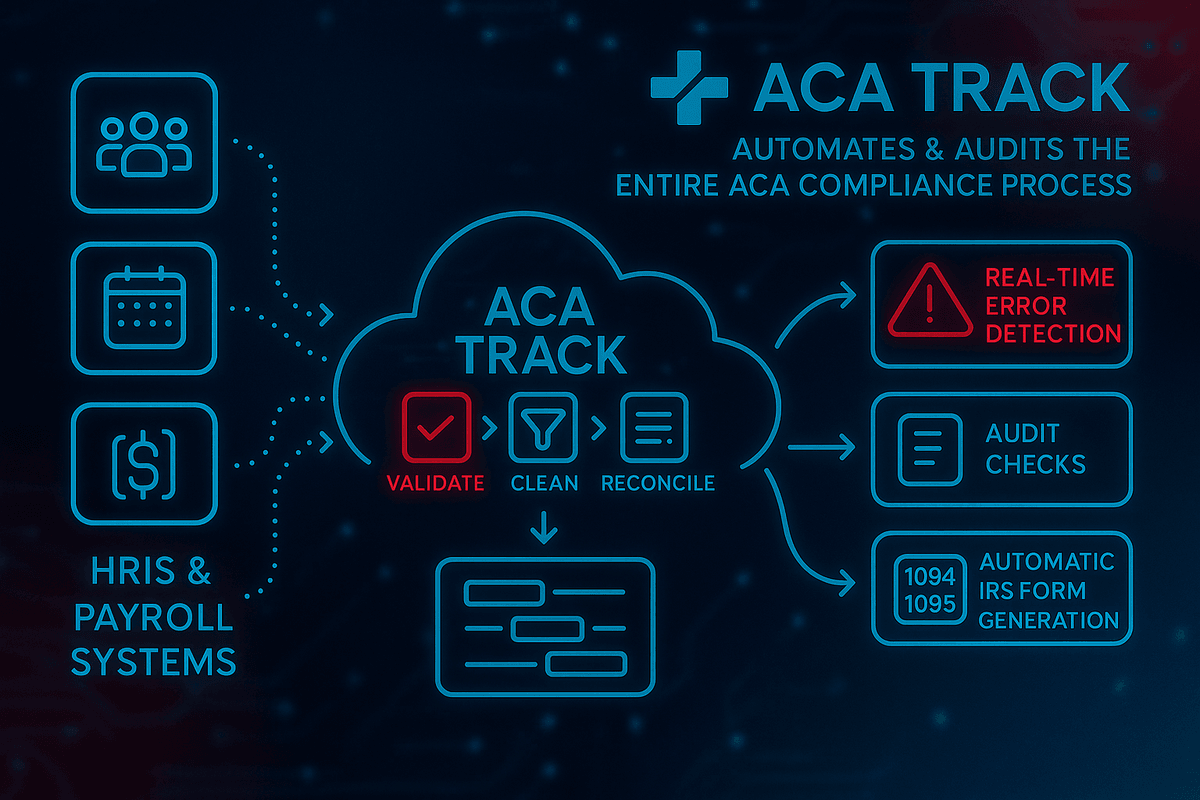

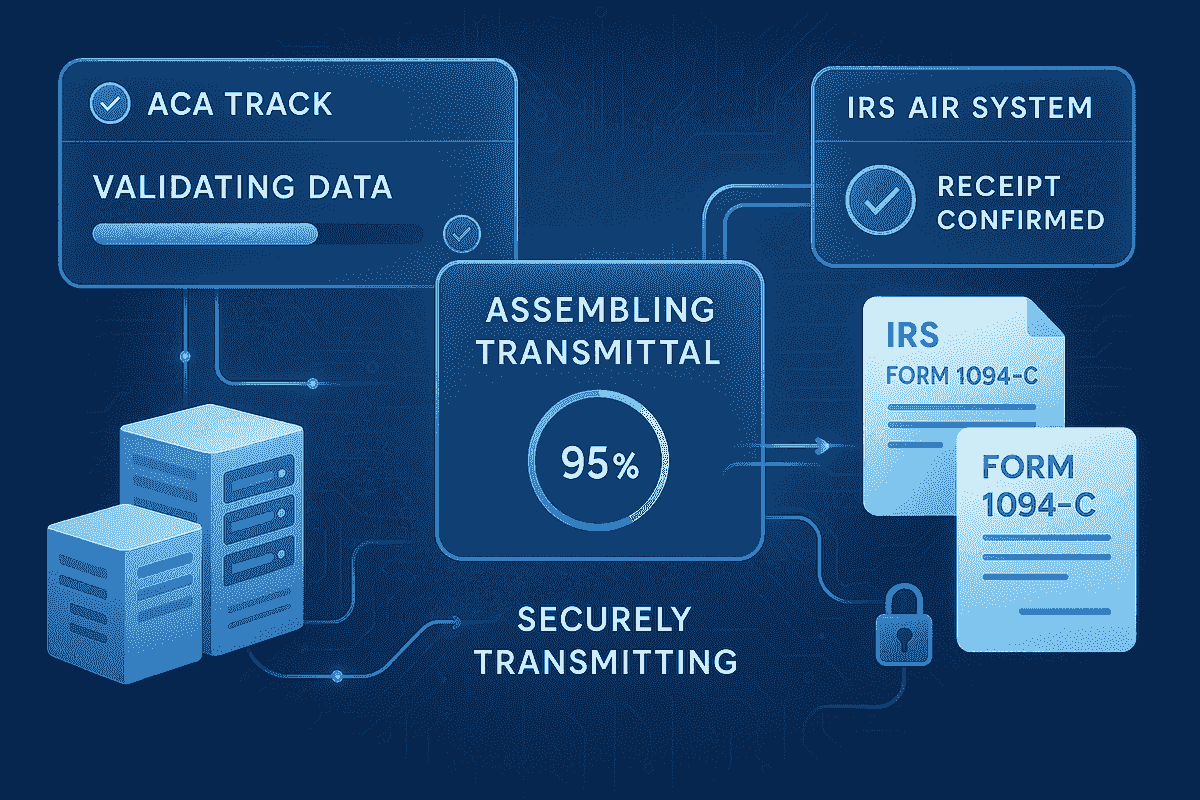

ACA TRACK’s Automation of Data Files enables seamless integration between clients’ HRIS, payroll, and benefits systems, automatically importing employee and coverage data without manual intervention. This process ensures accurate, real-time data synchronization for ACA reporting, drastically reducing errors and administrative workload during 1095-C preparation and submission.

- Consolidates Files: HR, payroll, and benefits data

- Audit: Runs over 250 compliance validations

- E-File: Auto-generates 1094-C transmittals

- Form Delivery: Delivers PDF and e-file-ready outputs

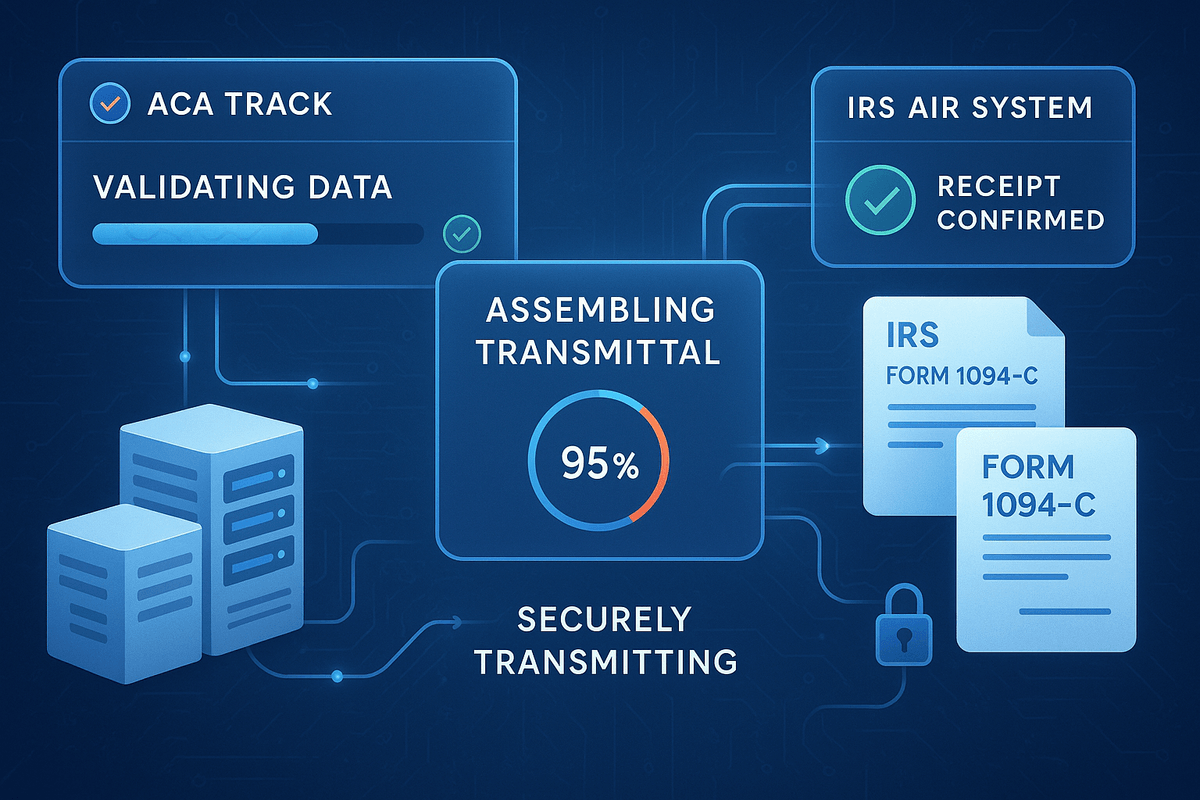

How ACA TRACK Automation Works

See how our compliance engine imports data, runs ACA validation rules, and files to the IRS

Case Studies & Metrics

Real results from ACA TRACK clients

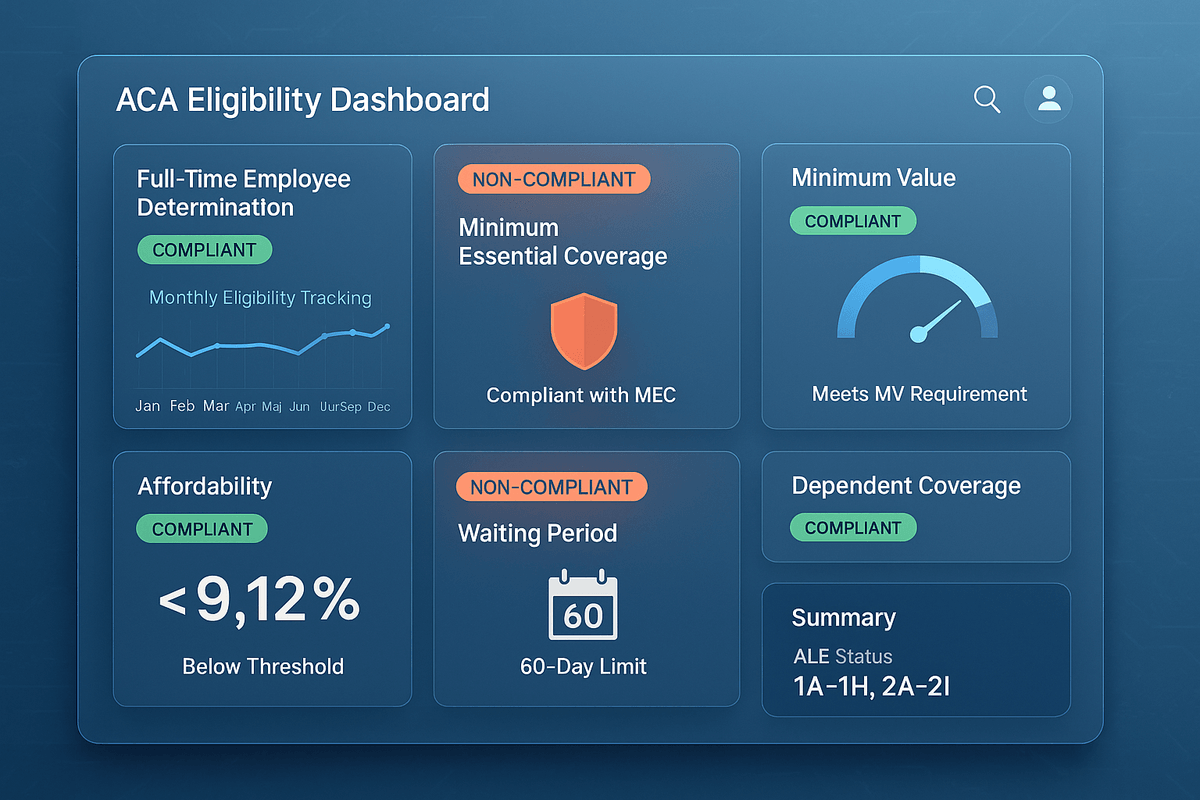

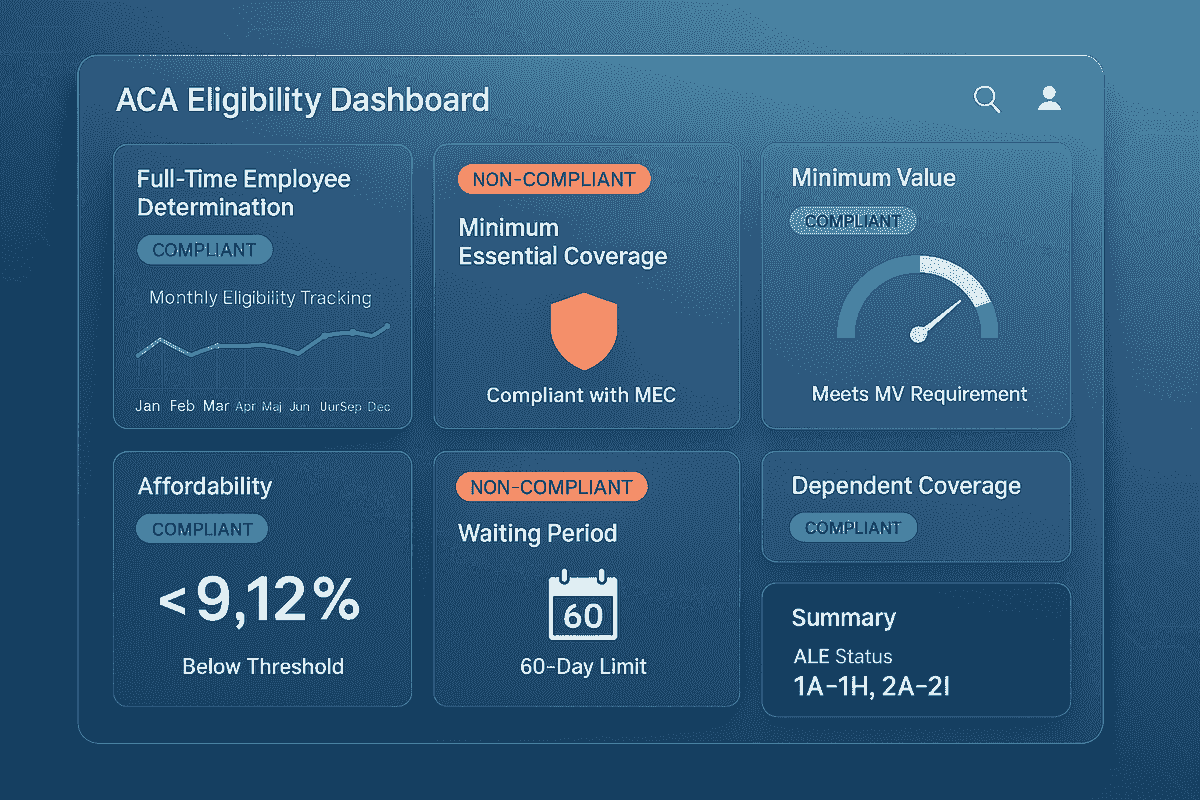

Real-Time Eligibility Monitoring

Tracks full-time equivalency across all payrolls and systems.

Detailed Employee Data Audit

Every transaction logged, reconciled, and exportable for audit response.

Automated 1094 IRS E-Filing

Direct, IRS-approved submissions with confirmation tracking.

State-Specific Compliance Engine

Automatically detects and applies filing rules in all active state mandates.

Schedule a 15-Minute

ACA Compliance Review

Our experts will walk you through automation and compliance improvements.

Copyright 2016

www.acatrack.net